Space Based Imagery Along with Real World Action

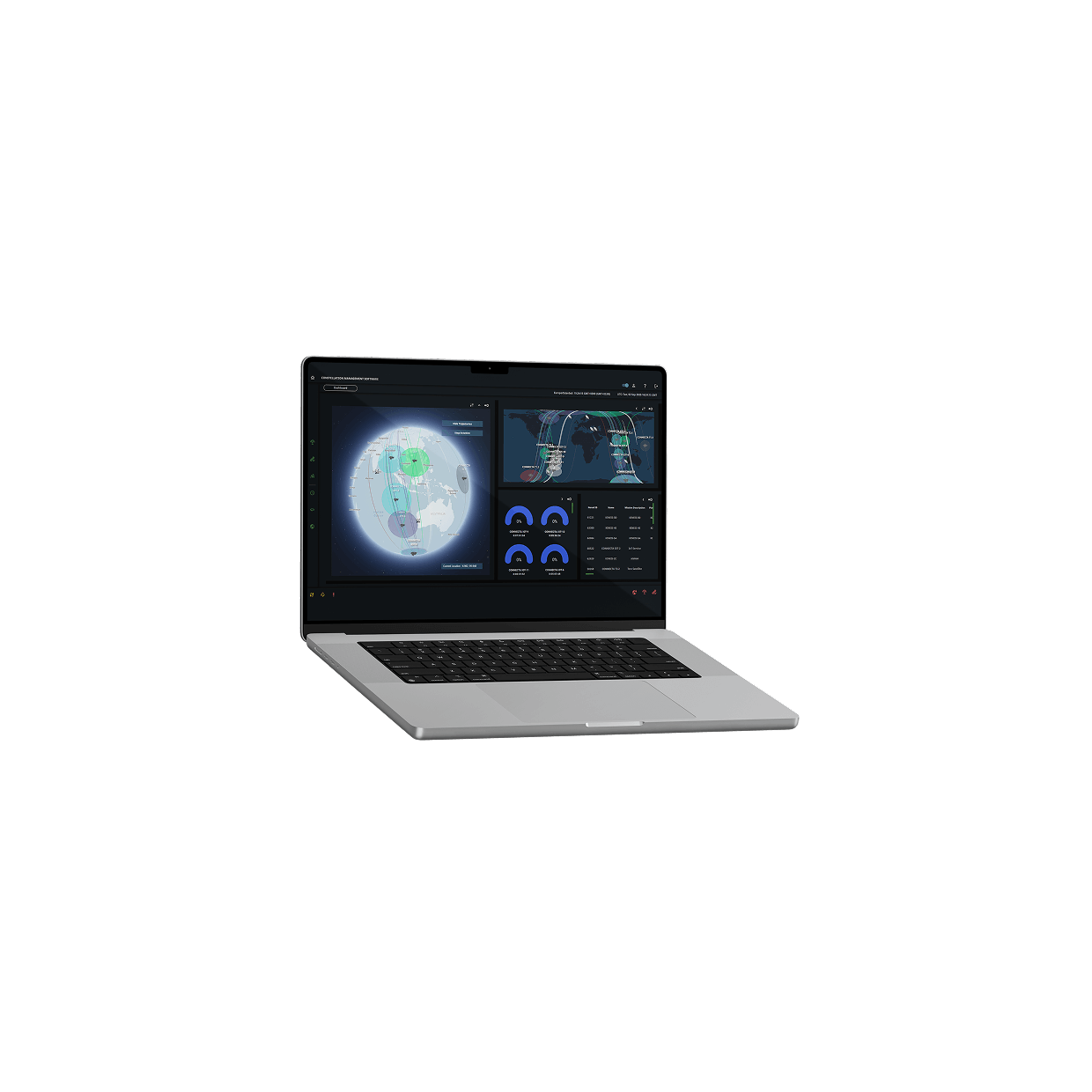

Observa unites a high-performance Earth observation capability with a single environment to search, order, task, process, analyze, and deliver insights, powered by AI workflows and supported by enterprise-grade security and governance.

Get in Touch

Get in Touch

PRODUCT OVERVIEW

Earth Observation Plus Actionable Intelligence

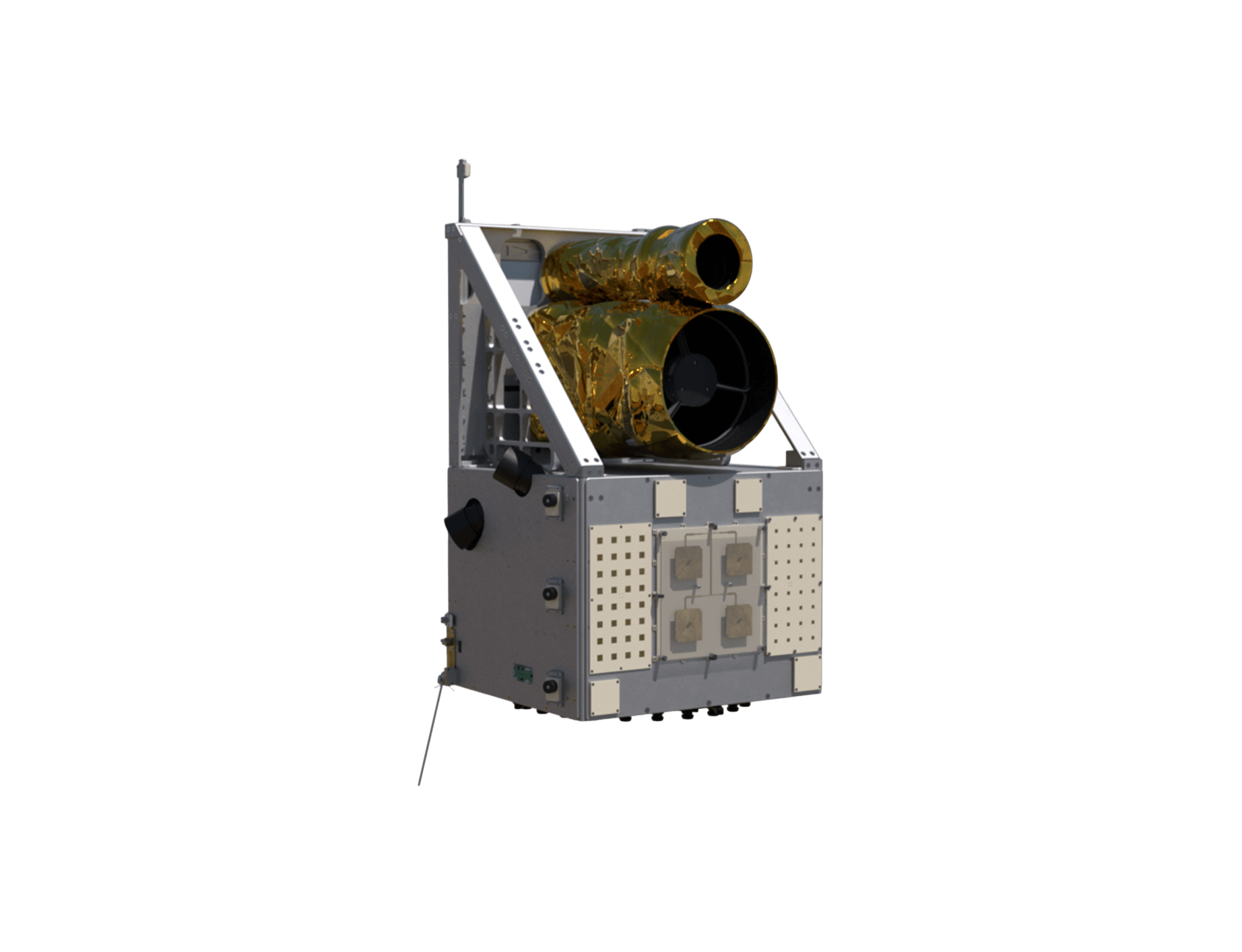

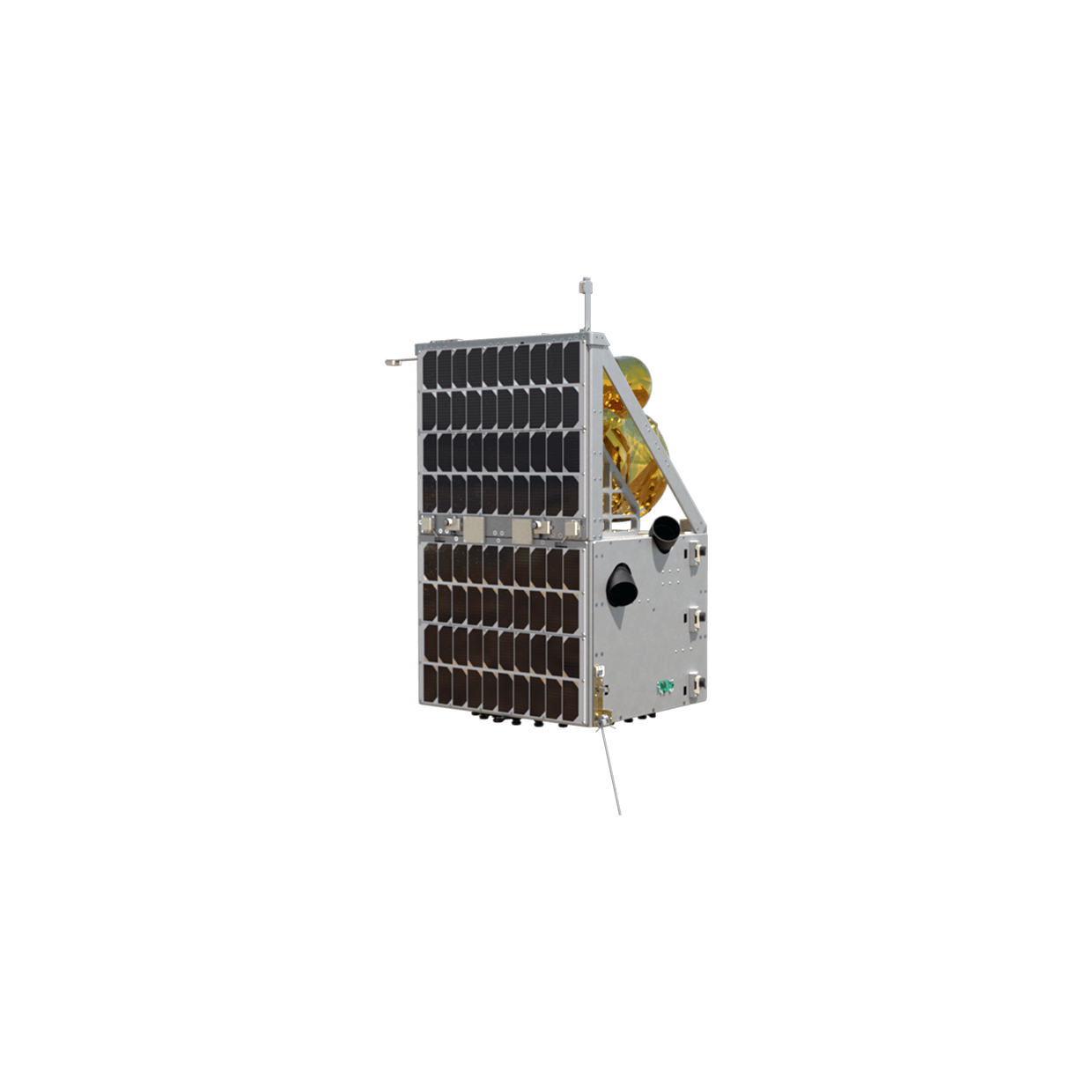

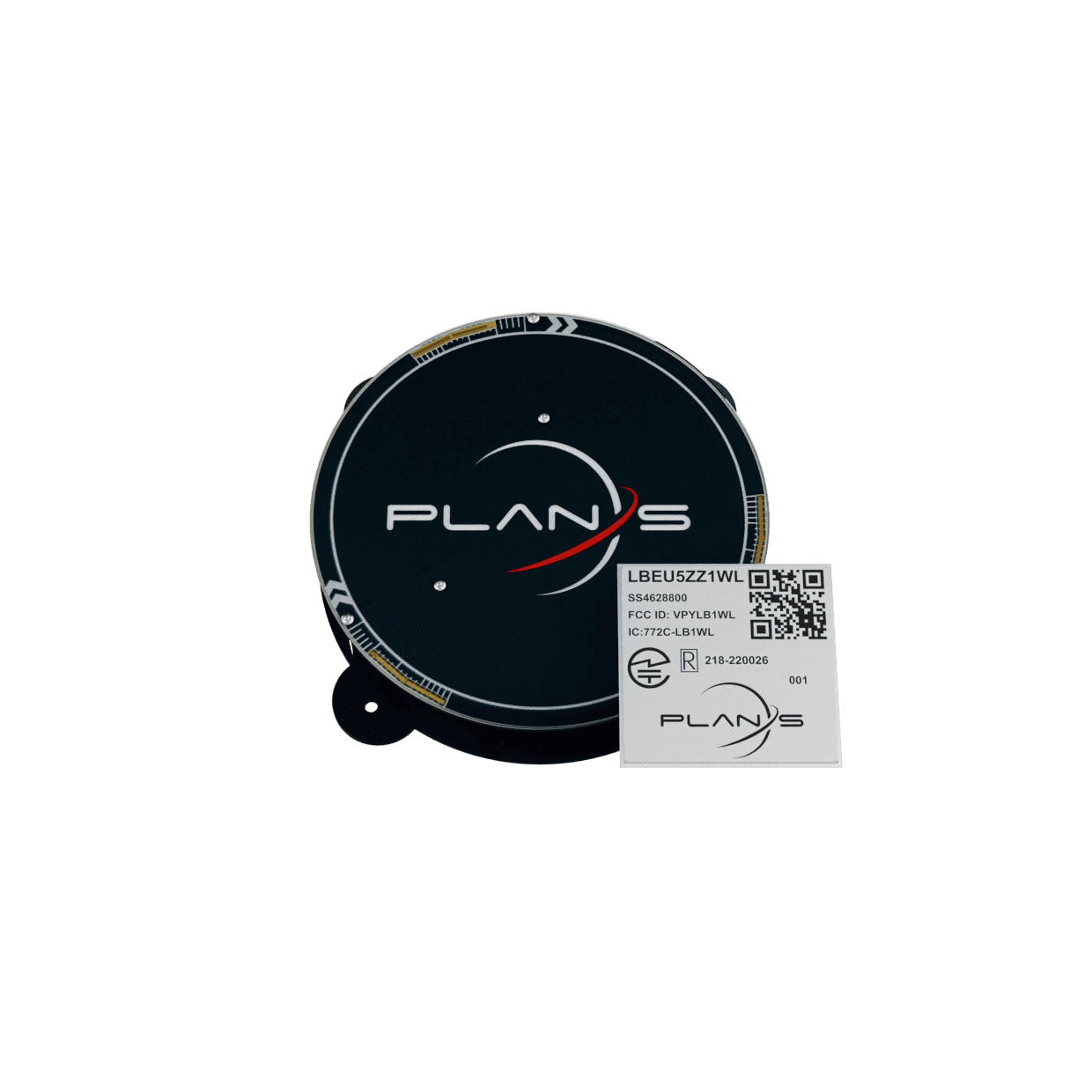

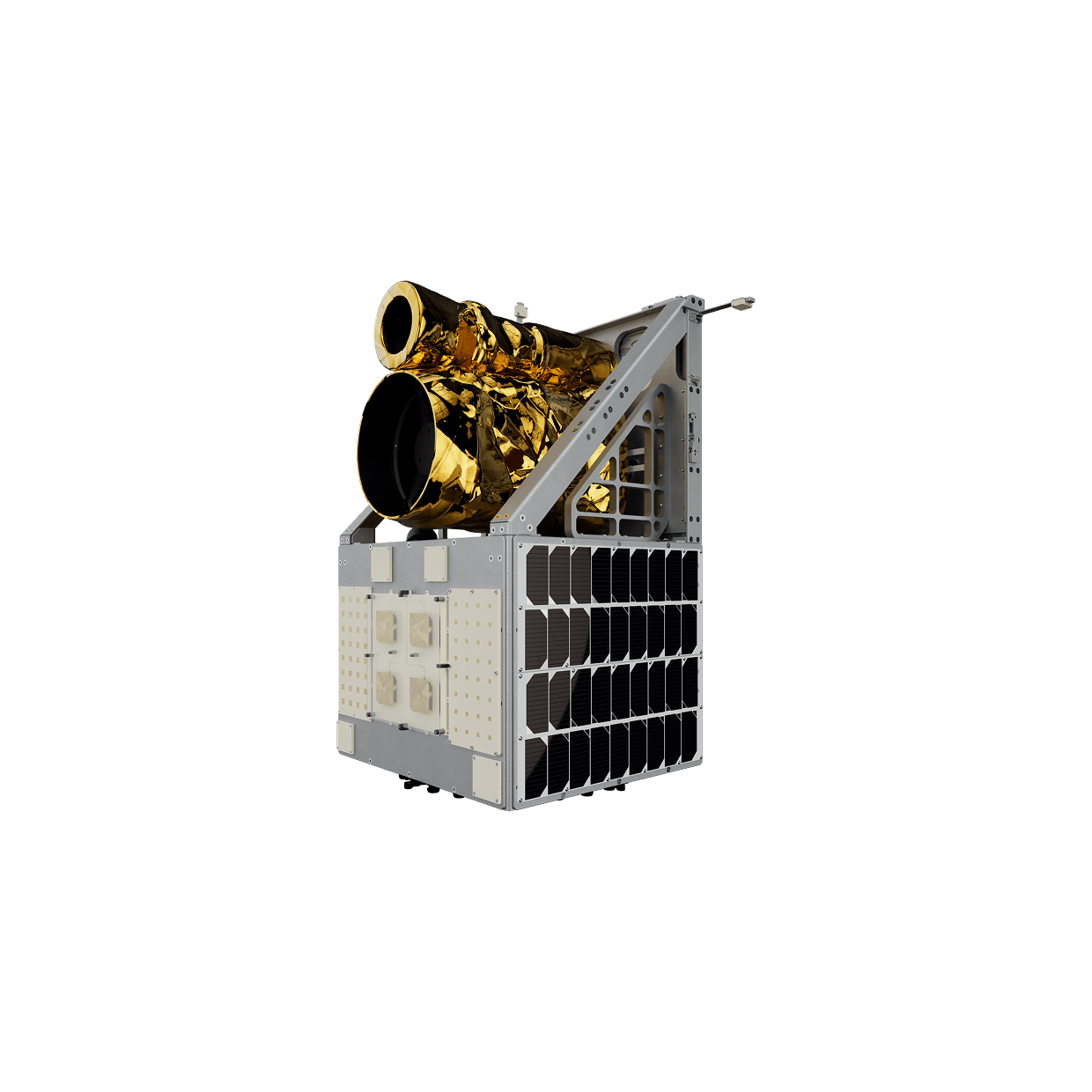

Observa brings together an Earth observation constellation, a high-performance imaging capability, and an AI-enabled processing pipeline to support sustainable development, critical infrastructure monitoring, climate intelligence, and national security missions.

To turn imagery into actionable outcomes, Observa Space Data Intelligence applies AI-driven workflows, detection, segmentation, classification, anomaly analysis, across multispectral, hyperspectral, thermal, SAR, and auxiliary datasets, supported by scalable architecture where accuracy matters.

OBSERVA SERVICES PORTFOLIO

End-to-End Services from Imagery to Intelligence

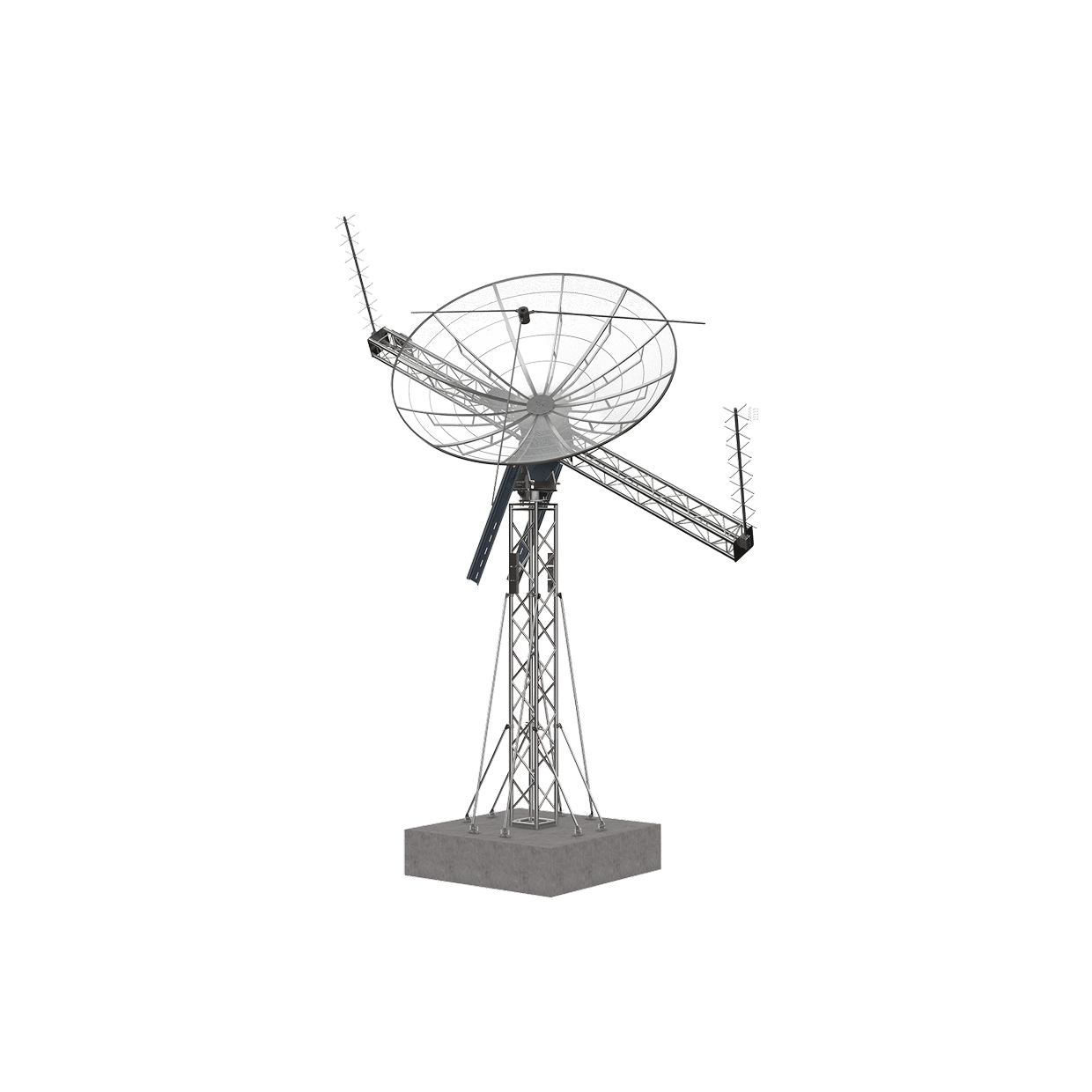

Observa is delivered as a modular product suite, satellites for image capture, and intelligence workflows that convert imagery into decision-ready outputs. Each component works independently, or as a fully integrated end-to-end Observa stack.

GET IN TOUCH

From Monitoring to Momentum

Observa is designed to move Earth intelligence from occasional reporting to continuous operational advantage. Define a target area, a monitoring objective, and an update cadence, then run the full loop in one environment: tasking and scheduling, standardized data handling, AI-driven analytics, and delivery through dashboards, alerts, reports, or exports into existing systems.

Get in Touch